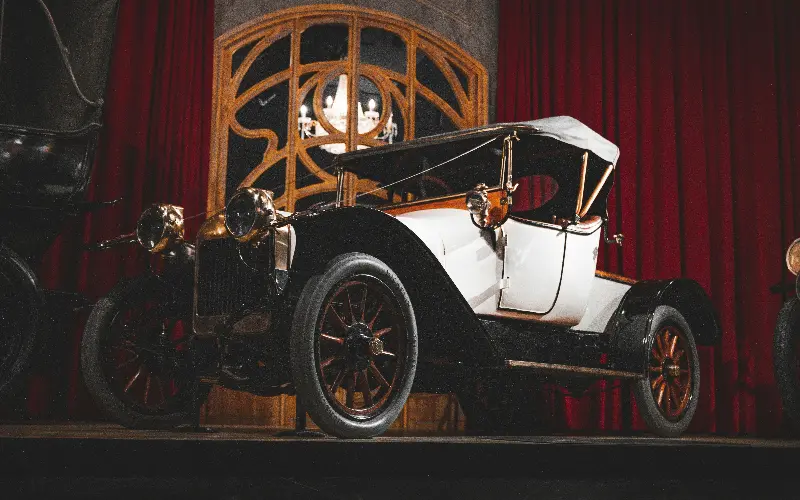

In a world where traditional investments like real estate and stocks have become the staple of many portfolios, a glossy contender with chrome fenders and roaring engines continues to capture both hearts and headlines—classic cars. For some, the allure of these automotive time machines goes far beyond financial returns.

They offer something that real estate, no matter how prime, simply cannot: emotion, nostalgia, and the exhilarating rush of owning a piece of rolling history. While a penthouse offers a view, a vintage speedster offers a soul.

The Emotional Engine Behind Classic Car Investments

Picture this: sliding behind the wheel of a perfectly restored 1960s Jaguar E-Type. The smell of aged leather and the gentle clunk of the gear shift transport you straight into a golden era. Unlike apartments or commercial spaces that often feel interchangeable, classic cars hold a unique personality—each design, purr of the engine, and paint shade tells a specific tale.

Investors are drawn not just to the potential appreciation of these rare machines, but also to the experiential dividends they pay. Recent data highlights the power of this passion:

- 60% of investors: Identify emotions and nostalgia as their primary motivation.

- Community Building: Attending car shows and rallies creates a social network rarely found in the quiet corridors of property management.

- Sensory Experience: The tactile nature of driving a manual gearbox provides a mental "reset" that a stock portfolio never could.

A Market That Defies Conventional Wisdom

Contrary to the concrete predictability of bricks and mortar, classic cars often dance to their own market tune. While the global real estate market can be sensitive to interest rates and local regulations, the classic car market has shown remarkable resilience.

During the financial crisis of 2008, while property values plummeted, certain segments of vintage and rare vehicles actually held their value—some even appreciated. The market’s top performers are dictated by:

- Rarity: How many were originally built?

- Provenance: Who owned it before? (e.g., a car with a James Bond or Steve McQueen pedigree).

- Originality: Does it have the "matching numbers" engine and original paint?

According to the Knight Frank Luxury Investment Index, classic cars outperformed traditional luxury assets over a recent decade, showing a staggering growth of nearly 185% between 2012 and 2022. Compare that to the steady but slower climb of many real estate markets, and the "engine of return" becomes clear.

Pitfalls, Peaks, And The Role Of Passion

Of course, revving up investments in this arena is not without its speed bumps. Unlike a real estate property that can passively generate rent, classic cars demand ongoing attention and specialized care.

The overhead costs can be significant, including:

- Climate-Controlled Storage: To prevent rust and leather degradation.

- Specialized Insurance: Agreed-value policies that reflect the car's true rarity.

- Maintenance: Sourcing parts for a 50-year-old Italian engine can run into thousands of dollars annually.

But for those who truly love cars, these “costs” feel less like chores and more like rites of passage. Car collectors describe the hunt for rare parts or the painstaking restoration process as emotionally rewarding endeavors that make the eventual profit even sweeter.

How Cars Win The Race Against Real Estate

Emotion aside, classic car investments have distinct tactical advantages over real estate. Automobiles are, quite literally, more mobile. They can be shipped globally to meet demand, are not bound to a depreciating neighborhood, and can be showcased at international auctions to enthusiastic, deep-pocketed buyers.

Liquidity also leans in the petrol-powered favor. While selling a house can take months of inspections and paperwork, sought-after classics can be auctioned off in mere minutes—hammer prices often exceeding expectations amid the gavel's drama.

Furthermore, tax treatment in many jurisdictions favors collectibles over real estate. Understanding these nuances can unlock additional value, especially for cross-border enthusiasts who strategize around international auctions and capital gains exemptions.

A Hobby-Driven Market With Financial Rewards

Perhaps the most distinguishing factor is that the classic car market is governed as much by culture and lifestyle as it is by economics. While most people buy homes for necessity or security, classic car collectors are motivated by a cocktail of aesthetics and the thrill of ownership.

From mid-century Mercedes Gullwings to air-cooled Porsches and the ever-charming Mini Cooper, icons from every era find their moment in the sun. It’s a reminder that, unlike a plot of land, a classic car is a dynamic asset—one that invites you to live the dream, not just count the digits.

In conclusion, while classic cars may not guarantee monthly rental income, they deliver something utterly unique: pure joy. For investors seeking to balance profit with passion, the classic car market remains a playground where emotion is the real engine of return.